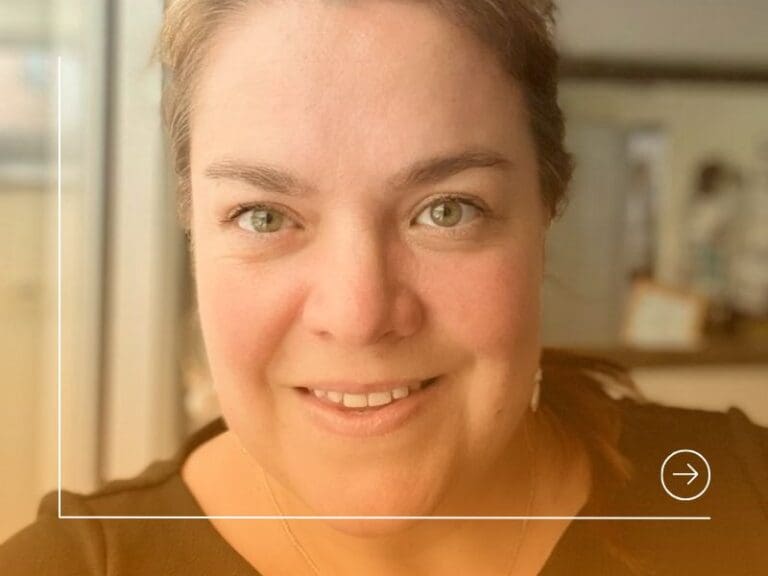

Hrefna Sigfinnsdóttir is an experienced and energetic leader with 30 years of experience in the financial services and fintech industry.

Before joining Creditinfo as CEO of Creditinfo Iceland, Hrefna worked at companies such as Landsbankinn and Nasdaq. Having served on the boards of several companies in Iceland and abroad, she is also one of the founding members of IcelandSIF, an independent forum for discussion and education on responsible and sustainable investments. Hrefna is also chair of Creditinfo’s ‘Women at Creditinfo’ initiative, which aims to promote gender equality, support career development and advocacy, and foster meaningful networking opportunities for all employees.

How did you land your current role? Was it planned?

Having worked in the financial sector for almost 30 years, I became increasingly familiar with and interested in the concept of sustainability in the industry. In my previous role as a manager at an Icelandic bank, I was committed to implementing ESG practices throughout the organisation. However, I soon realised there was a severe lack of standardised sustainability information available, especially for small and medium-sized enterprises, which drove me to my current role at Creditinfo Iceland. The position particularly appealed to me because of the opportunity and challenge I saw to help solve this lack of ESG data to drive more sustainable decision-making.

What are the key roles in your field of work, and why did you choose your current expertise?

When I chose a career in the stock market 30 years ago, it was very new here in Iceland. It was clear that many exciting developments were to come, and they certainly have!

My primary role is to lead and create a vision and framework so that staff and customers can flourish. I saw a great opportunity at Creditinfo, as the company has a very positive impact on society by helping to facilitate access to finance across the globe, which is a crucial part of maintaining a healthy financial services infrastructure.

Did you (or do you) have a role model in tech or business in general?

I’ve been very fortunate to have had some exceptionally strong role models throughout my career and have learned a lot from my superiors. Two role models stand out when it comes to my specific interest in responsible investments. The first was a manager at an international bank, and the other was a manager at the Norwegian Oil Fund, both of whom were mentors but also, most importantly, friends.

What are you most proud of in your career, so far?

I am most proud of all the great colleagues I have met and being able to watch their growth. Nothing makes me happier at work than working with good people and seeing their professional development.

I am also very proud of my involvement in establishing IcelandSIF, a professional association for investors to learn about sustainability, and launching Creditinfo’s ESG data platform, Vera. The platform provides diverse sustainability information for companies in Iceland, including data directly reported by companies and external sources such as media coverage, judicial information, and supply chain operations. I certainly see Vera as the first step in solving the lack of standardised sustainability information I encountered earlier in my career, as it’s something I’m particularly proud of being a part of.

What does an average workday look like for you?

No day is the same! As CEO, I have a very dynamic job. On one day, I may be meeting with the group’s executive board and working with our team across 30 countries to plan long-term operations, and the next, I’m diving into specific projects with the team in Iceland. It’s a demanding role but very rewarding. We are very project-oriented and aim to work according to a roadmap, but plans are constantly changing due to external circumstances and new customer demands, so flexibility is key!

Are there any specific skills or traits that you notice companies look for when you’re searching for roles in your field?

When hiring, we look for a diverse range of skill sets, including engineering, computer science and law, so that basic education in these fields can be very useful. Experience in project management and providing strong client service is another skill we look for, as it is crucial to our operations.

Has anyone ever tried to stop you from learning and developing in your professional life, or have you found the tech sector supportive?

I have only experienced great support and encouragement throughout my career. I find the sector I work in now particularly dynamic and modern, with flatter structures, more cooperation and less politics than other sectors I have experienced. I’d love to see this become more widespread across financial services.

Have you ever faced insecurities and anxieties during your career, and how did you overcome them?

I have experienced both insecurity and often stress throughout my career. Being able to turn to my colleagues for support has been instrumental in overcoming these anxieties.

Entering the world of work can be daunting. Do you have any words of advice for anyone feeling overwhelmed?

Knowing what you want to do and your purpose is essential. Map out the companies you think are compatible with your vision and contact them directly for potential opportunities. If you’re still at university, checking in with your professors and academic tutors to seek advice can also be a good idea. They will likely have cultivated strong relationships with key companies in their field and can help connect students to the right organisations.

What advice would you give other women wanting to reach their career goals in technology?

We can do anything and must be bold and pursue the opportunities we want. Finding a good mentor who will support and advise you through your journey is key.

What strategies should fintechs, and the finance industry more widely, be implementing to encourage women to join and grow in their roles?

My two priorities would be an equal pay strategy and a family-friendly environment. At Creditinfo, we recently launched our Women at Creditinfo employee resource group, which aims to promote gender equality, support career development and advocacy, and foster meaningful networking opportunities for all employees, with a particular focus on women. As the executive sponsor and chair of the group, I’m passionate about initiating changes across the finance and fintech industry. Employee resource groups are crucial for organisations to create space to listen to their employees’ priorities and use this learning to create direction.